2025.12.15

16th annual ranking reveals One Hundred People shaping global maritime today

2025.12.09

Lloyd’s List is proud to announce that Greg Miller, our senior reporter based in New York, has been named News Journalist of the Year at the Seahorse Freight Association Awards.

2025.12.01

Lloyd’s List Intelligence (LLI) is pleased to announce the appointment of Dr. Arne Staal as Chief Research Officer (CRO), a newly created executive role reporting directly to the Chief Executive Officer, Waqas Samad. In this role, Arne will unify and elevate LLI’s research, analysis and modelling capabilities to amplify the depth and reach of LLI’s qualitative and quantitative insights.

2025.11.26

Lloyd’s List Intelligence (LLI), the global leader in maritime data and analytics, marked a major milestone with the official opening ceremony of its new Centre of Excellence in Chennai on 21 November 2025. The inauguration was led by an esteemed delegation of dignitaries from the Government of the United Kingdom and the Government of Tamil Nadu, underscoring the strategic importance of this expansion in strengthening global maritime intelligence capabilities.

2022.11.10

Seasearcher now integrates Vortexa’s real-time energy and maritime data analytics into its Cargo Risk module, combining it with Seasearcher’s established risk and compliance capabilities. This unified platform simplifies the evaluation of risks associated with each vessel by leveraging data from two authoritative sources.

2025.11.11

Singapore/Hong Kong — Lloyd’s List Intelligence has been awarded Best TBML & Trade Compliance Solution at the 8th Regulation Asia Awards for Excellence 2025, celebrated in person on 10 November 2025, for Seasearcher Trade Risk 2.0.

2025.10.27

The maritime industry is entering a new phase of complexity as the United States and China implement reciprocal port fees, adding fresh layers of cost and regulatory scrutiny to international shipping operations. These measures, introduced on October 14, 2025, reflect broader geopolitical tensions and are prompting companies to reassess their exposure and operational strategies.

2025.10.23

Every day, Lloyd’s List Intelligence ingests hundreds of millions of AIS messages from vessels worldwide, adding up to billions each month. Behind these numbers, the focus is not only on collecting signals, but on ensuring AIS data becomes a dependable foundation for industry analytics, supporting compliance checks, voyage reconstruction, anomaly detection, and more.

2025.10.09

In today’s global economy, the organizations that thrive aren’t the ones with the loudest stories—they’re the ones with the clearest signals. Supply chain leaders, investors, and governments all face the same challenge: how to move beyond incomplete information and make confident, forward-looking decisions in an unpredictable world.

2025.10.01

In an increasingly complex geopolitical landscape, maritime companies face heightened compliance challenges. Recent sanctions activity has exposed critical vulnerabilities in ownership transparency that can have devastating financial and reputational consequences even for well-established financial institutions.

2025.09.29

When it comes to AIS data, coverage and quality are non-negotiable. But customers tell us time and again that what really makes the difference isn’t just the signals—it’s the support, the people, and the partnership behind them. AIS SeaOrbis was built to be more than a data feed. It’s an experience designed to de-risk transitions, accelerate integration, and give you confidence from the very first trial through to long-term partnership.

2025.09.25

Opaque ownership structures pose one of the most persistent challenges for trade risk assessment, sanctions and regulatory compliance. Understanding how these structures operate, and the tell-tale signs to look out for, is essential to assessing risk exposure, strengthening due diligence processes and ultimately protecting your business from harm.

2025.09.22

Since August 2022, Lloyd’s List has been tracking the Sea Opera (IMO: 9000883; Flag Cameroon), a Liquified Petroleum Gas Carrier built in 1991, loading Iranian products. The Sea Opera is not sanctioned, its owners/operators/managers are not sanctioned, but has been risk rated red in Seasearcher for AIS gaps, probable dark port calls, and concerns with its cargoes.

2025.08.27

In the fast-moving world of maritime technology, data quality and reliability make all the difference. For seabo, a digital solution focused on streamlining chartering workflows, the goal was simple: give users deeper vessel insights to help them make faster, smarter decisions.

2022.08.21

In the opaque world of maritime trade, transparency is critical. Yet, as sanctions tighten and illicit trade routes evolve, vessels are finding new ways to disguise their movements. One of the most troubling trends is AIS spoofing- the deliberate falsification of a ship’s location data.

.jpg?h=210&w=315&la=en-US&hash=15119A067508384588652E4118234314)

2025.08.18

Lloyd’s List Intelligence is delighted to announce the appointment of Waqas Samad as Chief Executive Officer. In his role, Waqas will spearhead the Company’s ongoing global expansion and drive ambitious innovation initiatives, ensuring that as geopolitical developments reshape global trade and heighten the strategic importance of the maritime sector, the Company continues to deliver comprehensive and forward-looking trade intelligence solutions.

2022.08.06

Iranian shipments to Houthi-controlled ports have unveiled a troubling trend of sophisticated manipulation within maritime operations. Recent investigative reporting from Lloyd’s List highlights intricate efforts to obscure vessel identities and bypass international oversight mechanisms, spotlighting a critical gap in maritime security and compliance.

2025.08.04

Managing maritime claims demands speed, accuracy, and defensible evidence. Yet many teams still work with fragmented, outdated, or unverified data - putting outcomes and reputations at risk.

2025.08.04

The maritime sector requires rapid, informed decisions - but that’s only possible with dependable intelligence. Seasearcher combines rich data coverage with advanced analytics to support maritime professionals every step of the way.

2025.08.04

A March evening, dense fog, and two vessels on a collision course off the UK coast. What followed was a high-stakes claims investigation - one that relied on Seasearcher for resolution.

2025.08.04

Claims professionals operate in high-pressure environments. Delays, missing data, and vague reporting can derail even the best-handled cases. Seasearcher streamlines every step with tools built for your world.

2025.08.01

In an increasingly complex regulatory environment, it is vital for businesses to highlight and assess risks associated with status or operations that can influence or change the way they deal with shippers, suppliers, or their own customers.

2025.07.30

In the high-stakes world of maritime compliance and sanctions enforcement, the ability to detect AIS manipulation is essential. Nowhere is this more evident than in the waters off Malaysia’s coast, where shadow fleet tankers are exploiting regulatory gaps and limited enforcement capacity to carry out illicit ship-to-ship (STS) transfers of sanctioned oil.

.jpg?h=210&w=315&la=en-US&hash=15119A067508384588652E4118234314)

2025.07.14

At Lloyd’s List Intelligence, the quality of our data underpins every decision we help our clients make. That’s why we continue to invest in the completeness, accuracy, and timeliness of our maritime intelligence, principles that sit at the heart of our COACT framework.

2025.06.25

At Lloyd’s List Intelligence, data quality is at the heart of everything we do. As a data-driven, tech-enabled business, we are constantly looking for ways to improve the accuracy and timeliness of our insights, two pillars of our proprietary COACT framework (Consistency, Origin, Accuracy, Completeness, Timeliness).

2025.06.16

That stark figure, revealed in Richard Meade’s recent Lloyd’s List analysis, underscores a growing problem: the maritime industry is struggling with compliance complexity at precisely the moment when emissions regulations are tightening worldwide.

2025.06.01

The IMO’s newly approved carbon pricing scheme has brought global attention to shipping’s decarbonisation challenge.

2025.05.27

The methods involved in manipulating location information are constantly evolving and becoming more difficult to track, but many spoofing events can still be identified if you know what to look for…

2025.05.22

The International Maritime Organization (IMO) has reached a historic milestone. After years of debate, it has approved the first globally binding carbon price for shipping — the J9 credit trading plan and fuel standard, voted through at MEPC83. While far from perfect, this agreement marks a turning point in the maritime sector’s decarbonisation journey.

2025.05.21

In April, the U.S. Treasury’s Office of Foreign Assets Control (OFAC) issued a critical update to its September 2019 advisory for the Maritime Petroleum Shipping Community.

2025.05.21

OFAC’s latest advisory on Iranian oil sanctions revealed an alarming surge in deceptive shipping practices—from multi-leg STS transfers to AIS spoofing. Confronted with ever-evolving risks, compliance teams need more than static lists: they require a proactive, data-driven solution. Enter Lloyd’s List Intelligence’s Seasearcher platform, which combines AI-powered anomaly detection, rich maritime datasets, and risk-based workflows to transform your sanctions compliance posture.

2025.05.13

THE UK has sanctioned 100 tankers today, its biggest ever package of sanctions against Russia’s dark fleet and alerting compliance professionals across the global maritime industry that trade with UK-based companies.

2025.05.12

Maritime investigations are inherently complex, requiring accurate insights into vessel movements, environmental conditions, and potential risks. Traditional tools often fail to deliver the integrated intelligence required for timely and precise analysis. To keep up, the industry is moving towards platforms that unify diverse data sources for quicker, more reliable decision-making.

2025.05.12

Beneath the vast oceans lies a critical network of subsea infrastructure that keeps the world connected and energised. Subsea cables carry 99% of global data traffic, while pipelines transport essential energy resources across continents. However, this critical underwater infrastructure (CUI) faces increasing threats from sabotage, natural disasters, and accidental damage, making its protection a key priority.

2025.05.12

Maritime claims and legal investigations often face delays due to outdated, manual mapping methods. These processes are not only time-intensive but also prone to human error, leading to inaccuracies that escalate disputes and prolong case resolutions. Sharing findings without a centralised system further complicates communication.

2025.05.09

The legal profession has always relied on thorough research, but the way lawyers access and analyse legal information has changed dramatically. Traditional research methods, such as manually sifting through case law reports, have been overtaken by specialist digital platforms that offer faster, more accurate and more comprehensive insights.

2025.05.09

The legal profession is undergoing a profound transformation, driven by technological advancements and the increasing digitisation of legal resources. In an era of growing complexity, legal practitioners must adopt more efficient ways to access, interpret, and apply legal information to ensure well-informed decision-making.

2025.05.09

Maritime law has long provided the legal framework for commercial activities at sea, governing contracts, torts, and the rights and responsibilities of shipowners, cargo interests, insurers, and seafarers. As global trade expands and maritime industries evolve, so too must the legal principles that underpin them.

2025.05.09

Legal professionals operate in a fast-moving and demanding environment, where new laws, regulations and judicial precedents emerge constantly. Without reliable legal resources, staying up to date can be challenging, making research and case preparation more difficult. In a profession where knowledge is power, having the right tools provides a competitive advantage, allowing legal practitioners to offer well-founded advice and representation.

2025.04.11

Discover the future of vessel tracking with AIS SeaOrbis by Lloyd’s List Intelligence. Now integrating VDES for real-time, secure, global maritime data — built for what’s next.

2025.03.26

Tracking sanctioned vessels and cargoes is increasingly difficult as evasion tactics grow more sophisticated. Practices like transponder tampering, false documentation, or ship-to-ship transfers complicate compliance efforts. To mitigate risks of penalties and reputational damage, companies must adopt transparent processes supported by advanced tools to detect deceptive activities.

2025.03.26

The global nature of shipping presents numerous challenges in tracking sanctioned entities. Tactics like ship-to-ship transfers, transponder manipulation, and document falsification complicate enforcement. Meanwhile, evolving international sanctions require constant vigilance to avoid financial and reputational risks. Robust systems and partnerships are essential for effective compliance.

2025.03.26

The global shipping industry is navigating an increasingly complex web of compliance challenges. Sanctions, once a policy tool, have become a significant risk factor embedded in financial, insurance, and political systems. While impactful under campaigns like Trump’s “maximum pressure,” enforcement gaps have exposed vulnerabilities. Shipping companies now face evolving evasion tactics—such as dark fleets and AIS signal manipulation—forcing them to rethink compliance strategies.

2025.03.26

The shipping industry is facing an unprecedented challenge in navigating sanctions compliance. While banks have spent years building robust compliance frameworks, shipping companies are far behind. The rapid, sweeping sanctions against Russia have exposed major gaps in the sector’s ability to manage risk. With compliance teams often non-existent and overstretched general counsel taking on the load, many businesses struggle with conflicting regulations across jurisdictions. The result? A compliance minefield where even small mistakes can lead to costly penalties.

2025.02.26

In today’s fast-evolving maritime landscape, visibility is everything. Whether monitoring global trade flows, assessing security risks, or optimising logistics, having a complete and accurate picture of vessel movements is critical. Yet, for too long, maritime stakeholders have had to rely on fragmented data sources, each with its own limitations.

2025.02.20

In maritime intelligence, satellite AIS often gets positioned as the ultimate tracking solution. While its global reach is invaluable, its true strength lies in complementing terrestrial and shipborne AIS, rather than replacing them. By integrating all three, we create a seamless, consistent, and highly accurate maritime intelligence network.

2025.02.11

In the ever-evolving world of maritime intelligence, accuracy and completeness in vessel tracking are paramount. While satellite AIS provides coverage in remote mid-ocean regions and terrestrial AIS excels in coastal areas, there has always been a critical data gap in the in-between zones—the busy but offshore shipping lanes just beyond terrestrial range.

2025.02.05

In the world of maritime intelligence, there’s a common misconception that satellite AIS is the primary data source for vessel tracking. While satellite AIS plays a valuable role, it’s terrestrial AIS that serves as the foundation for the most reliable and actionable insights thanks to the much lower data latency—especially in high-traffic zones.

2025.01.14

In one of its final acts, the Biden administration announced the most aggressive round of shipping sanctions in years on Friday, January 10 targeting more than 180 vessels and dozens of entities and individuals involved in Russian oil and gas trades and production, including oil traders, insurance companies and energy officials.

2025.01.13

Lloyd’s List originally identified the vessel as Tanzania-flagged Xing Shun 39, rather than Cameroon-flagged Shun Xing 39. The two — and a third vessel — are most likely the same ship, Lloyd’s List Intelligence data shows

2025.01.09

The Red Sea is experiencing a notable shift in maritime activity, particularly in the average daily number of active vessels. Among the affected sectors, containerships, general cargo ships, and vehicle carriers stand out as they exhibit downward trends, marking a departure from both recent and historical patterns.

2025.01.09

Managing risk exposure effectively is critical for insurers, especially in an unpredictable world where factors like geopolitical conflicts, extreme weather events, and economic turmoil can significantly impact operations. However, the traditional methods of collecting and analysing scattered data have long created challenges, from inefficiencies and delays to inaccuracies in decision-making.

2024.11.19

The maritime industry faces a growing web of global sanctions, environmental regulations, and compliance requirements that are reshaping how companies navigate international waters.

2024.10.23

The maritime industry is advancing rapidly, with data-driven insights now at the forefront of decision-making. Granular port data, particularly when combined with Automatic Identification System (AIS) data, has emerged as a game-changer.

2024.10.08

The maritime industry is undergoing a profound transformation, with the rising importance of harnessing a range of big data sources such as AIS (Automatic Identification System) data to identify and manage potential risks.

2024.09.12

This data is essential for maintaining efficient operations, ensuring compliance, and optimising business development strategies. Alternative fuel and engine types are increasingly being utilised on vessels, creating market problems but also opportunities.

2024.09.12

Staying compliant while optimising operations is a complex task in the constantly evolving maritime industry. Compliance analysts and industry professionals are always searching for innovative tools to gain a better understanding of vessel activities while mitigating risks effectively.

2024.07.26

Vessels that fit the Houthi’s so-called “target profile” are doing more than just rerouting to avoid being targeted by the Iranian-backed militant group.

2024.06.25

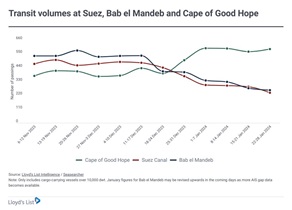

The recent spate of attacks on commercial shipping in the Red Sea, including two incidents in which vessels were abandoned and one ultimately sank, has had no initial effect on Bab el Mandeb transits, according to Lloyd’s List Intelligence data.

2024.05.30

When navigating the complex world of maritime trade and compliance, the most valuable asset at your disposal is accurate, reliable data – especially in sectors where poor insights could lead to multi-million financial losses and fines.

2024.05.08

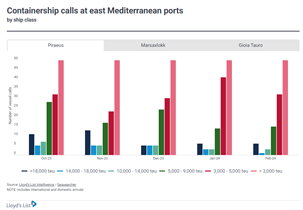

Shipping’s recent extended rerouting of east-west trades around the Cape of Good Hope, to avoid potential Houthi attacks in the Red Sea, has led to huge increases in throughput at some ports, while others have seen dramatic declines.

2024.04.16

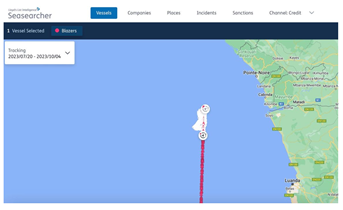

Lloyd’s List Intelligence vessel tracking picked up one such example with the case of Blazers, which suspiciously spent an extensive period drifting in ballast in international waters off Angola’s coastline.

2024.03.21

Lloyd’s List Intelligence vessel tracking picked up one such example with the case of the Shanaye Queen, which raised eyebrows when it seemingly executed an impossibly rapid diversion to Pakistan’s Karachi anchorage.

2024.03.21

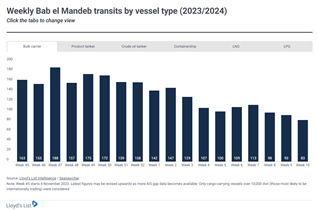

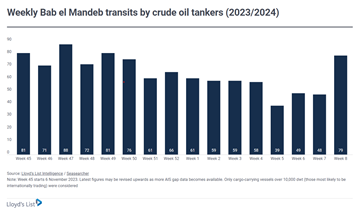

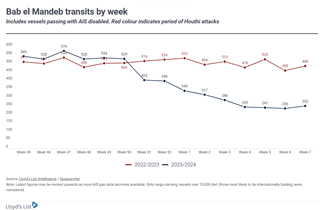

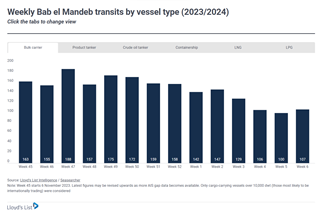

There was a small increase in vessel transits through the Bab el Mandeb strait at 229 in the week ending March 17 (week 11 of 2024), compared with 219 in the previous seven days.

2024.03.14

There was a new low in total transit volumes of all vessel types through the Bab el Mandeb strait in the week ending March 10 (week 10 of 2024) with just 218 passings recorded. This is 60% lower than the ‘normal’ pre-Houthi attack average in vessel terms and 57% down compared with the same week last year.

2024.03.06

The number of bulk carriers transiting the Bab el-Mandeb Strait plunged to a fresh low for the week ending March 3 as Houthi attacks on commercial shipping pushed overall traffic in the region 53% lower compared with the year-ago period.

2024.02.28

Despite the increasing frequency of Houthi attacks on commercial shipping in the Red Sea in recent weeks, the number of cargo-carrying vessels over 10,000dwt increased to a daily average of 240 in the week ending February 25, up from 213 vessels in the previous week.

2024.02.27

In a world where the sea is a vital conduit for international trade, understanding the integrity of maritime operations is paramount. However, the waters are muddied by deceptive practices that not only breach international laws, but also threaten global commerce. The case of the vessel Abyss, flagged by Palau, serves as a stark reminder of the risks lurking in the shadows of the shipping industry.

2024.02.21

For the first time since the Houthi attacks on commercial shipping in the region started in December, vessel transits through the Bab el Mandeb strait increased week on week.

2024.02.14

Passings through the Bab el Mandab strait are showing signs of stabilisation with vessel transits falling by 4% from last week to around 231, although this figure will increase when factoring in vessels switching off their AIS transmitters. However, this is down from 459 vessels in the equivalent week (6) of 2023.

2024.02.07

Numbers reflect cargo-carrying vessels of 10,000dwt+. Pre-Houthi attack average taken for the period November 6 - December 3, 2023.

2024.01.31

Tanker operators are rerouting vessels away from the Red Sea in the wake of a Houthi attack which left a Trafigura-chartered vessel in flames over the weekend.

2024.01.09

Analysis of Lloyd’s List Intelligence data shows how ships have been redeployed to continue trading, while others maintain regular voyages, revealing the limits of US sanctions programmes.

2024.01.09

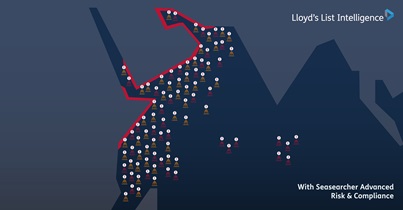

Radiating World Shipping Services LLC, one of the world’s largest dark fleet tanker operators and ship managers, is moving its tankers to a newly formed company to avoid UK sanctions. Read expert analysis conducted by Lloyd’s List on the growing trend of dark fleet operators engaged in Russian trades evolving their management structures to avoid sanctions, with data sourced from Seasearcher Advanced Risk & Compliance.

2023.10.13

The US, Australia and members of the Group of Seven countries have announced a long-anticipated crackdown on evasive and deceptive shipping practices to breach price caps imposed on Russian oil trades, in their first maritime advisory on sanctions in more than three years.

2023.07.26

The first port to introduce containerisation to the nation, it lost the primacy to the west coast port of Los Angeles in 1989, as booming trade with China boosted the Pacific gateway.

2023.07.25

Reliability, resilience and security of production locations and supply chains have become more important due to the pandemic and concurrent geopolitical tensions.

2023.07.23

EU member states have adopted an 11th package of sanctions that confirm plans to ban access to EU ports for ships which engage in ship-to-ship transfers if there is cause to suspect the cargo is of Russian origin.

2023.07.13

Our data shows that, for every sanctioned vessel that continues to commit probable dark port callings and dark ship-to-ship transfers, there could be three more vessels not on any sanctions list that are actively taking part in the same type of probable illicit activity.

2023.05.11

Read expert analysis conducted by Lloyd’s List Intelligence on the high number of dark vessels and AIS gaps around the Kerch Strait, with research sourced from Seasearcher Advanced Risk & Compliance.

2023.04.27

When it comes to sanctions compliance, the maritime industry needs more than the basic vessel tracking tools.

2023.04.27

Read expert analysis conducted by Lloyd’s List Intelligence on the continuing trade of blacklisted vessels in spite of recent international sanctions, with research sourced from Seasearcher Advanced Risk & Compliance.

2023.04.05

Russia’s industrial scale sanctions-evasion programme is growing more complicated and sophisticated, courtesy of an ever expanding “dark fleet” of subterfuge shipping and a shadowy network of brass plate companies and middlemen beyond the reach of Western interventions.

2023.02.06

The conflict in Yemen has the potential to spill over into shipping, and while it is unlikely that international commercial trade will be a direct target, data reveals why governments are so keen to keep the Bab al-Mandeb Strait secure.

2023.01.24

How Predictive Fleet Analytics provides reliable predictions based on a broad range of data to aid decision making across the maritime industry

2022.12.22

Vladimir Putin’s invasion of Ukraine has led to the biggest land war in Europe since 1945, the biggest commodity shock since the 1970s and the most far-reaching sanctions regime since the 1930s.

2022.12.21

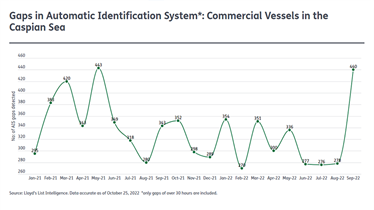

Russia’s maritime trading patterns out of Sea of Azov ports is increasingly being obfuscated by vessels switching off their automatic identification systems (AIS).

While the frequency of ships switching off AIS in the Kerch Strait has been elevated since the outset of the military activity in Ukraine, the number of AIS gaps has risen dramatically since September.

2022.12.16

Although raw AIS data is the default go-to for information, it’s difficult to plan ahead when about 32% of vessels sail without a destination logged, 36% of vessels’ AIS transmissions do not include ETAs. Even when those transmissions do include ETAs, 27% of vessels arrive late. Information inaccuracies lead to wrong judgments and cause significant logistical, competitive, and financial challenges — including spoiled cargo, wasted fuel, excess pollution, or additional demurrage and detention (D&D) charges.

2022.12.13

Supply chain resilience became a political imperative as bottlenecks wiped a conservative 1% off global GDP. Businesses moved from ‘just-in-time’ to ‘just-in-case’ procurement, stockpiling billions of dollars’ worth of inventories as a form of insurance in an increasingly uncertain world.

2022.12.09

The oil price cap is the latest in a series of escalating sanctions against the Russian Federation, implemented by mainly Western nations and intends to reduce the revenue Russia earns from oil, weaken its economy and starve funding for its war in Ukraine.

2022.11.24

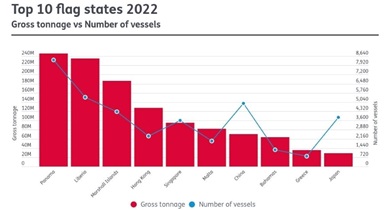

Panama has retained its position as the world’s leading flag state in terms of gross tonnage for 2022 but is facing strong competition from Liberia, which is rapidly closing the gap to its rival, while China also recorded exceptional growth in the past 12 months.

2022.11.15

In our quest to make everyday life easier, neater and nicer, we surround ourselves with stuff that, in certain circumstances, can be harmful: kitchen and bathroom cleaning products, paint, and air fresheners, for example.

2022.11.11

Seaborne trade between Iran and Russia via the Caspian Sea, a suspected route for weapons shipments, is increasing and ships plying the trade are routinely doing so with Automatic Identification System (AIS) signals turned off.

2022.11.11

Russia’s supply chains have shown resilience since the invasion of Ukraine, with cargo flows being redirected to ‘friendly’ countries using transport corridors touted by President Vladimir Putin as long-term priority trade routes.

2022.11.11

International shipping is under more scrutiny than ever. Here's how advanced maritime data can help ensure regulatory compliance.

2022.11.03

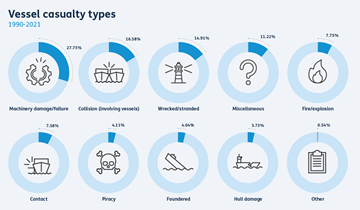

Casualty reports totalled 700 in the third quarter of 2022, the highest number of incidents since 2008.

2022.11.02

Gain insight into future vessel activity with Predictive Fleet Analytics for supply chain efficiency and to pinpoint sales potential.

2022.10.28

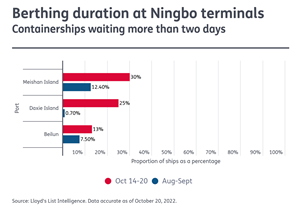

Port congestion and increased berthing times - the new normal under China’s strict Covid policy

2022.09.07

The deal to allow the safe transport of grain out of the Ukraine by sea was an unprecedented agreement between enemy combatants. Yet, the potential risks of using the corridor during the ‘safe’ window of time were considered significant.

2022.08.16

Making sense of a spider web of digital information, false leads and anecdotes involves persistence, intuition and the ability to dive deep into the world’s preeminent store of marine data.

2022.06.15

A new offshore logistics network is evolving to transport Russian oil and circumvent the restrictions of sanctions and expensive insurance.

2022.05.27

Marine businesses are often forced to deal with vessel ETA inaccuracies. What are the knock-on effects and how can organisations secure better ETA data?

2022.05.23

Sanctions compliance is getting more complex. Learn the smart way to maximise protection and minimise risk when lending to the shipping industry.

2022.04.20

As the supply chain crisis evolves and new areas of risk emerge, another trend has become apparent: a growing global fleet of moribund vessels, saved from the scrapyard by persistently high freight rates and the illicit oil trade.

2022.04.14

Predictive Fleet Analytics is revolutionising supply chain management by giving reliable and accurate data you cannot find anywhere else.

2022.03.18

Is your AIS data incomplete or unreliable? For many shipping professionals, this spells disaster with time and money wasted on poor conclusions and misallocation of resources. Today, we’ll share 7 tips to help bridge your maritime data gaps so you can boost efficiency for your fleets or vessels of interest.

2022.03.09

Increasingly complex sanctions compliance standards leave operators more exposed to penalties - unless they have an advanced risk and compliance solution.

2022.03.04

For the people involved in keeping our oceans safe, marine casualty data is critical, but it’s also increasingly vital to keep the world’s economy moving.

2022.02.10

Discover how AIS signals work and how they can be combined with advanced data analysis to identify risky behaviour at sea.

2022.01.19

As ports and global shipping become ever more complicated, accurate geospatial ports data can be the key to efficiency and costs savings

2021.12.17

Operations at ports are increasingly busy and complicated. Cut through the complexity with reliable and advanced maritime data.

2021.11.04

Learn how our COACT framework delivers accurate and reliable maritime data to enable intelligent compliance risk management, monitoring of maritime trade and smarter commercial strategy.

2021.07.23

The movement of illicit cargo across water is increasingly difficult to pinpoint. Tactics used by owners and operators to conceal the transport and exchange of materials that are sanctioned are evolving and becoming increasingly sophisticated.

2021.07.23

The key to success in identifying maritime compliance risk is being able to understand and rate patterns of high-risk behaviour and activity as quickly as possible. Ideally, to do so as soon as the activity emerges and before it reaches alarming levels.

2021.06.15

The constantly moving and changing maritime industry needs data and insight that evolves. That’s why we’ve teamed up with SAS, leading innovators in artificial intelligence. When machine learning is applied to our powerful historical and real-time database, new and more advanced insight about vessel and fleet behaviour emerges.

2020.11.25

Accurate and timely vessel tracking data is the backbone of the maritime industry because it makes shipping operations safer, more efficient, and more effective.