The International Maritime Organization (IMO) has reached a historic milestone. After years of debate, it has approved the first globally binding carbon price for shipping — the J9 credit trading plan and fuel standard, voted through at MEPC83. While far from perfect, this agreement marks a turning point in the maritime sector’s decarbonisation journey.

But what does this mean for maritime operators in practice? And why does access to reliable emissions data now matter more than ever?

The new framework introduces a two-tier credit trading scheme alongside a fuel standard designed to gradually reduce ships' carbon intensity. In essence, vessels will be financially incentivised to lower emissions, while higher-emitting ships will face mounting costs.

Key components include:

While this is the first global carbon price for any sector, it is — as Lloyd’s List editorially described — “a faltering step towards net zero”, with initial stringency lower than many had hoped. Yet, it sets a precedent, laying the groundwork for tougher measures in future.

Despite criticism that the scheme “allows for business-as-usual emissions until 2028”, the financial implications are clear. Operators can no longer afford to ignore emissions performance. With the introduction of global and regional regulations, emissions will directly impact:

Other regimes, like the EU ETS and FuelEU Maritime, further amplify compliance pressures. FuelEU, for instance, could impose penalties surpassing €7m by 2034 for non-compliant fleets, as reported by Lloyd’s List.

In short, decarbonisation is no longer aspirational, it’s becoming a direct commercial driver.

The shift to emissions-based compliance demands granular, reliable vessel emissions data. Operators need visibility of both fleet-level and voyage-level emissions to:

Yet, fragmented data sources and inconsistent methodologies make this challenging. Manual data collection adds time, cost, and increases the risk of errors — precisely when accuracy is critical.

This is where Lloyd’s List Intelligence’s Seasearcher emissions data comes in.

Integrated directly into the Seasearcher platform and accessible via API, our emissions solution provides:

By embedding emissions data into your existing workflows, we remove friction from compliance tracking and enable smarter, data-driven decisions — whether for compliance, business development, or risk assessment.

The IMO’s carbon pricing framework might be a compromise, but it is a clear signal of intent. Emissions transparency will define commercial competitiveness in the years ahead.

With Seasearcher emissions data, maritime operators can move beyond reactive compliance and take control of their decarbonisation strategy.

Learn how Seasearcher’s emissions data simplifies compliance tracking

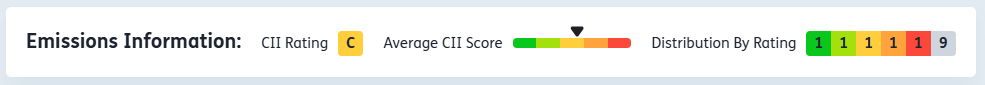

Our emissions data, integrated into Seasearcher and available via API, provides vessel and voyage efficiency ratings (CII and AER), empowering users with the intelligence needed to navigate decarbonisation challenges and stay competitive.