The IMO’s newly approved carbon pricing scheme has brought global attention to shipping’s decarbonisation challenge. While compliance is now non-negotiable, the smartest operators are viewing this as more than a box-ticking exercise - they see emissions performance as a lever for competitive advantage.

In this second part of our emissions series, we explore how data-driven emissions insights are reshaping decisions in chartering, financing, insurance, and fleet strategy - and how tools like Seasearcher emissions data are helping turn compliance obligations into commercial opportunities.

Emissions Performance as a Market Differentiator

As highlighted in our previous blog, regulations like the IMO’s carbon price, EU ETS, and FuelEU Maritime are making emissions performance financially material. But beyond penalties, emissions data is now influencing commercial relationships and market positioning.

Chartering & Voyage Selection

Charterers and brokers are factoring emissions ratings into vessel selection, alongside traditional metrics like availability and cost. As a leading Charterer stated:

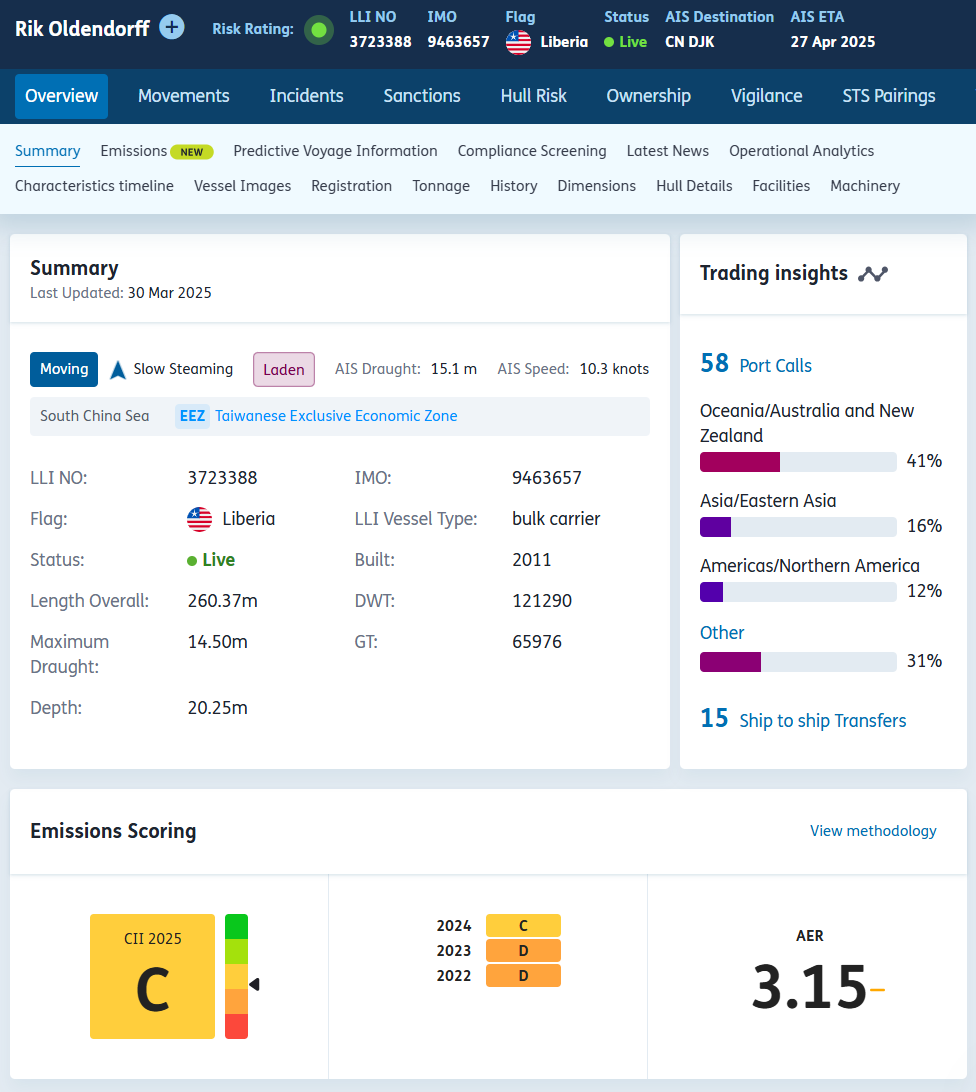

“When vetting vessels, preference is given to those with a C-rated CII and above… this needs to be directly integrated into our systems.”

Operators who can demonstrate superior emissions performance gain a clear edge in securing charters - particularly as stakeholders demand greener supply chains.

Financing & Insurance

Banks responsible for 80% of global ship finance have committed to the Poseidon Principles, aligning their portfolios with IMO’s emissions reduction trajectory. This means vessel emissions performance directly impacts loan availability, terms, and refinancing options.

Insurers, too, are tightening underwriting criteria based on emissions metrics. As a Lloyd’s List Intelligence customer noted:

“We want to partner with customers who follow greener policies… this will impact policies and underwriting decisions going forward.”

Operators who proactively manage emissions can unlock preferential financing, insurance coverage, and green loan incentives.

The Strategic Role of Emissions Data

Turning emissions performance into a competitive advantage requires accurate, timely, and accessible data. Here’s where emissions intelligence becomes critical:

.jpg)

Seasearcher Emissions Data: Turning Insight into Advantage

Lloyd’s List Intelligence’s Seasearcher emissions data is designed to support this strategic shift.

Through our platform and API, users can:

By integrating emissions intelligence into daily workflows, Seasearcher empowers maritime professionals to make faster, smarter decisions, not just for compliance, but for growth.

A Competitive Future Starts with Visibility

In a sector where margins are tight and reputational risks are high; emissions transparency is rapidly becoming a source of competitive differentiation. Operators who embrace data-driven emissions management will be better positioned to navigate regulatory pressures, access green financing, and secure new business.

Our emissions data, integrated into Seasearcher and available via API, provides vessel and voyage efficiency ratings (CII and AER), empowering users with the intelligence needed to navigate decarbonisation challenges and stay competitive.