Sanctions have become a go-to diplomatic tool to help achieve foreign policy objectives, and Russia and Iran are two of the most sanctioned countries in the world. Sanctioned vessels may have a limited sphere of operation, but restrictions have not led to a cease in trading.

Source: Yörük Işık CRUDE TANKER YAZ, PICTURED TRANSITING THE BOSPHORUS TOWARDS THE BLACK SEA FROM SYRIA, WAS SANCTIONED BY OFAC IN 2019.

Analysis conducted using data from Lloyd’s List Intelligence’s vessel-tracking solutions has focused on Automatic Identification System messages and gaps, to understand how these blacklisted vessels continue to trade — and with whom.

The five ships sanctioned in relation to Russia’s occupation of Crimea — product tankers Sudak (IMO:8943155) and Sig (IMO: 9735335), chemical tanker Stalingrad (IMO: 9690212), and combined chemical and oil tankers Marshal Zhukov (IMO: 9690224) and Yaz (IMO: 9735323) — have been sanctioned for several years and have well-defined voyage patterns.

Sig and Yaz, for example, only travel between Russia-controlled areas in the Black Sea and the Sea of Azov down to the Mediterranean Sea, going dark on the approach to Cyprus.

“These ships are working for Russian armed forces or other Russian government contractors,” said Yörük Işık, a geopolitical analyst from the Istanbul-based consultancy Bosphorus Observer. “Not only are these ships sanctioned themselves, but the company that owns them is sanctioned, all their routes are sanctioned, and they are technically trading stolen petroleum from an unlawfully seized property of the Ukrainian government.’’

Stalingrad and Marshal Zhukov now focus on trade within the Volga-Don River system and the Caspian Sea, reflecting a broader supply chain shift. The Caspian Sea has emerged as a hotspot for sanctioned vessels and a booming legitimate trade route through Iran, connecting India to Russia - and it is common for vessels to operate off the radar when trading in the region.

Blacklisted ships often operate off the radar to obfuscate their movements. However, many ships under sanctioned status are trackable at certain points in their voyages and call at ports with their AIS on.

Some 72 ships were directly sanctioned by the US Treasury’s Office of Foreign Assets Control, known as Ofac, at various points in 2022 under the executive order 12024, which blocks property with respect to “specified harmful foreign activities of the government of the Russian Federation”.

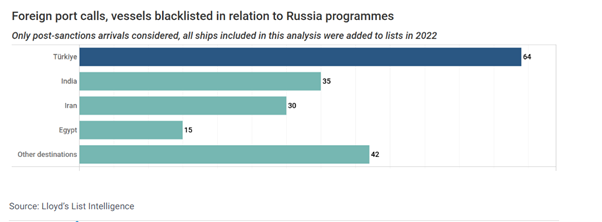

These ships made more than 1,100 on-the-radar port calls in 2022 while sanctioned, most of which were local. Still, since being blacklisted, Russia’s sanctioned ships have berthed at ports in 28 foreign countries, sailing most often to Türkiye, India, Iran and Egypt.

Countries that accept blacklisted ships usually maintain friendly relations with Russia despite its invasion of Ukraine. Türkiye has helped offset the loss of some of Russia’s Western trading partners more broadly, with economic ties strengthening significantly between the two countries throughout the course of the war. India has remained on good terms with Moscow and its businesses are taking advantage of circumstances to pick up discounted Russian commodities, but there are other reasons sanctioned ships sail to Indian waters.

Sanctions measures levied by Western governments did successfully cut off these Russian ships from certain markets in Europe, Scandinavia and North America, which accounted for 34% of their port calls in 2021. However, exceptions occasionally occur, such as when the ro-ro Baltic Leader arrived at the French port of Boulogne-sur-Mer in February 2022. The ship was intercepted and escorted there by the French navy under suspicion of belonging to a Russian bank subject to EU sanctions.

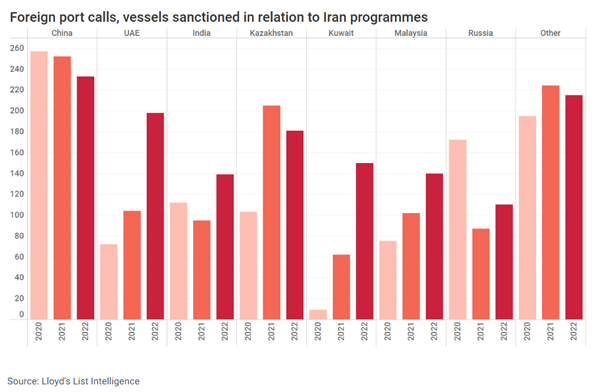

Many vessels blacklisted under exclusive Iran programmes have been sanctioned for several years. Their trading relationships are well established, but activity still fluctuates and evolves annually.

Neighbouring countries and other Asian destinations remain popular. In 2022, there were 256 on-the-radar calls to the United Arab Emirates, 233 to China and 181 to Kazakhstan. Improved relations between Iran and the UAE, as well as Saudi Arabia, likely contribute to this shift.

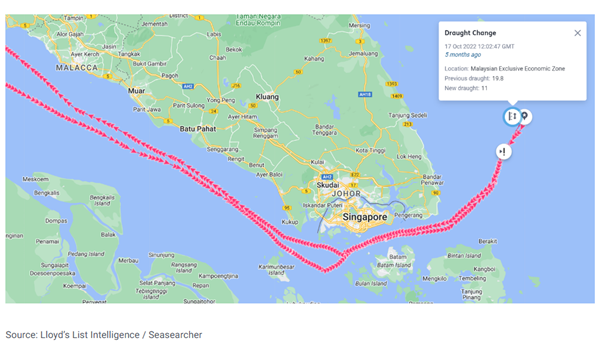

Although fewer on-the-radar port calls are being made by Iran's sanctioned oil tankers, there has been an increase in AIS gaps on the route running through the Singapore Strait.

Crude oil tanker Hero II travels from the Gulf of Oman, largely with its AIS off, appears during the transit of the Singapore Strait and goes dark. The vessel logs a draught change when it reappears before heading back the way it came

According to Lloyd’s List Intelligence vessel-tracking data, there were 63 AIS gaps associated with blacklisted Iranian crude oil tankers, up from 27 in 2021. “We are seeing more AIS gaps in the Singapore Strait and more dark ship-to-ship transfers occurring in the area,” said US monitoring group United Against Nuclear Iran chief of staff Claire Jungman. “I believe this increase in STS transfers from sanctioned tankers to non-sanctioned tankers allows more exports of Iranian oil and is more efficient for Iran because they do not have to go all the way to China.”

In conclusion, the direct sanctioning of ships does not prevent them from trading or doing so on an international scale. The success of sanctions depends on the rationale behind the measures and the intended outcome of such restrictions.

For more in-depth information on shipping risk and compliance, download our Special Report.