The maritime industry is entering a new phase of complexity as the United States and China implement reciprocal port fees, adding fresh layers of cost and regulatory scrutiny to international shipping operations. These measures, introduced on October 14, 2025, reflect broader geopolitical tensions and are prompting companies to reassess their exposure and operational strategies.

Understanding the New Port Fees

The US has introduced port fees targeting vessels with Chinese affiliations — whether through ownership, operation, or construction. China has responded with similar charges for US-linked vessels. Both sets of fees are structured to increase annually through to 2028, and they apply differently depending on vessel type and ownership profile.

US Port Fees:

China Port Fees:

Financial Implications

The financial impact is significant, particularly for container vessels and vehicle carriers. For example:

These costs are prompting companies to reevaluate their ownership structures, vessel flagging, and port call strategies.

Industry Response

Shipping companies are taking proactive steps to mitigate exposure:

These strategic shifts underscore the importance of clarity in ownership definitions and the need for flexibility in fleet management.

The Role of Lloyd’s List Intelligence

In this evolving regulatory landscape, access to accurate data and expert analysis is more critical than ever. Lloyd’s List Intelligence supports maritime stakeholders by:

As global shipping adapts to these new dynamics, informed decision-making will be key to maintaining resilience and competitiveness.

Providing clarity on the 25%

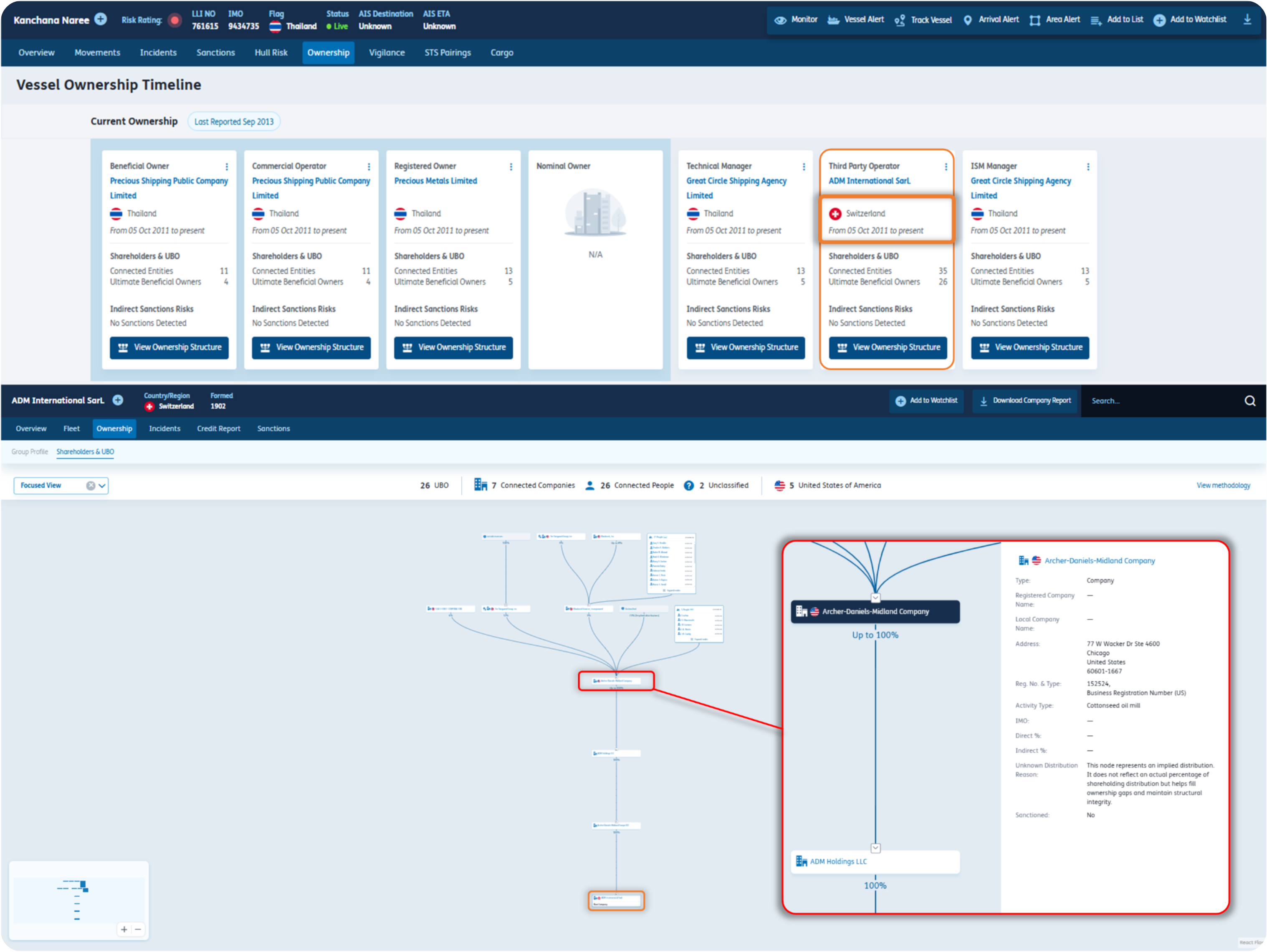

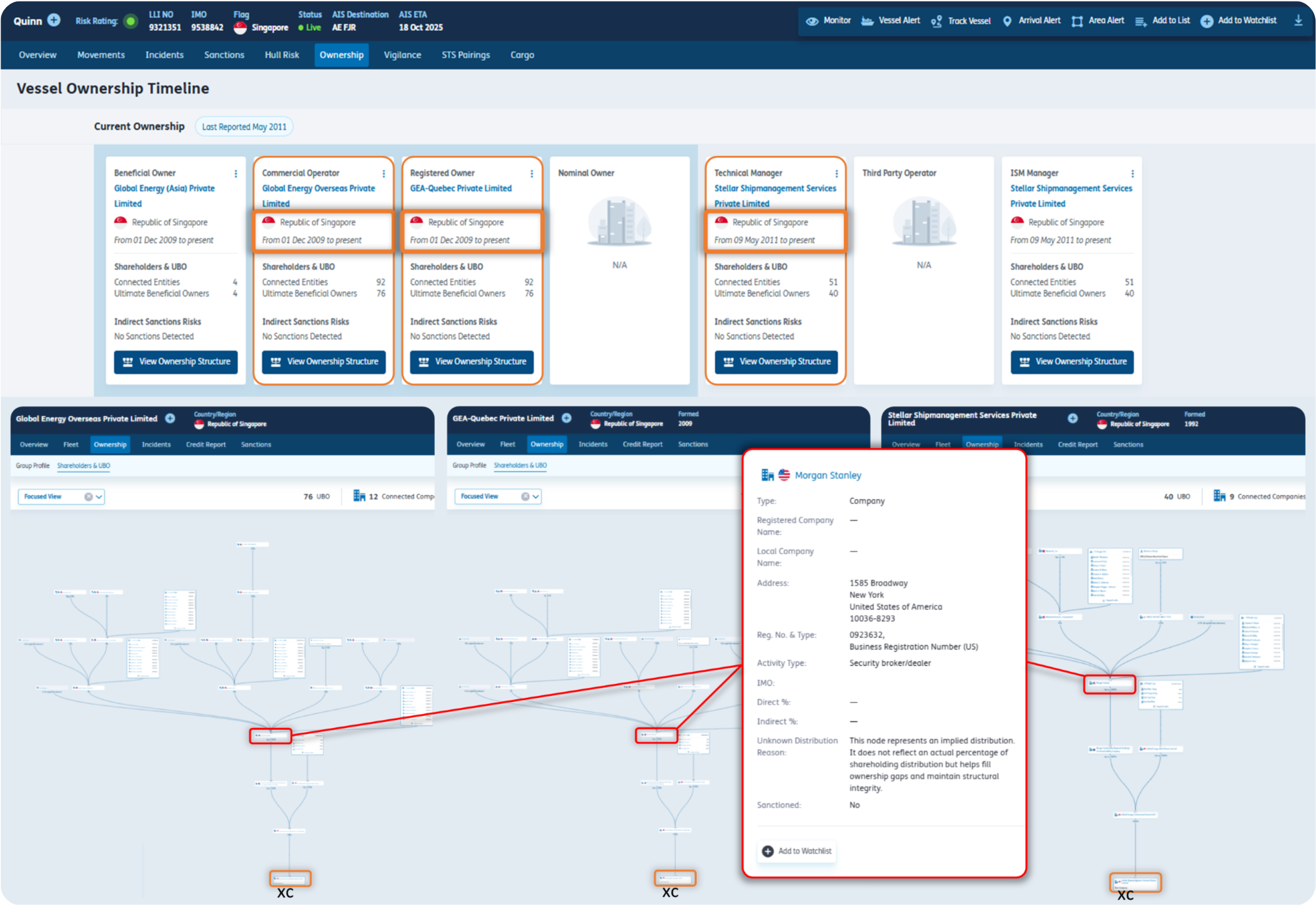

Seasearcher’s Ownership Intelligence solution can trace shareholders with US affiliations behind subject entities – providing intelligence on any significant stakes (e.g. ≥25%), the number of US shareholders, and their degree of separation from the vessel. The examples below focus on how our platform assists in identifying vessels that are, or have the potential to be, liable to Chinese port fees.

Examples:

Ownership Intelligence Insight: ADM International Sarl has five US shareholders, resulting in 100% US ownership two levels up (Chicago-based Archer-Daniels-Midland Company).

Ownership Intelligence Insight: Three separate companies, serving as the Registered Owner, Commercial Operator, Technical Manager, and ISM Manager of the vessel, each have five US shareholders, resulting in up to 100% US ownership three levels up (New York-based Morgan Stanley).

Seasearcher’s Ownership Intelligence solution maps out complex ownership structures within maritime trade – providing actionable insights to assist risk-based decision making.

Don’t get caught out – learn more about Seasearcher: Ownership Intelligence today!

Designed for maritime professionals seeking enhanced visibility on opaque ownership structures, links to sanctioned entities, and cargo movements intelligence.