Complex compliance requirements

Identifying Red Flags in Trade has never been more challenging

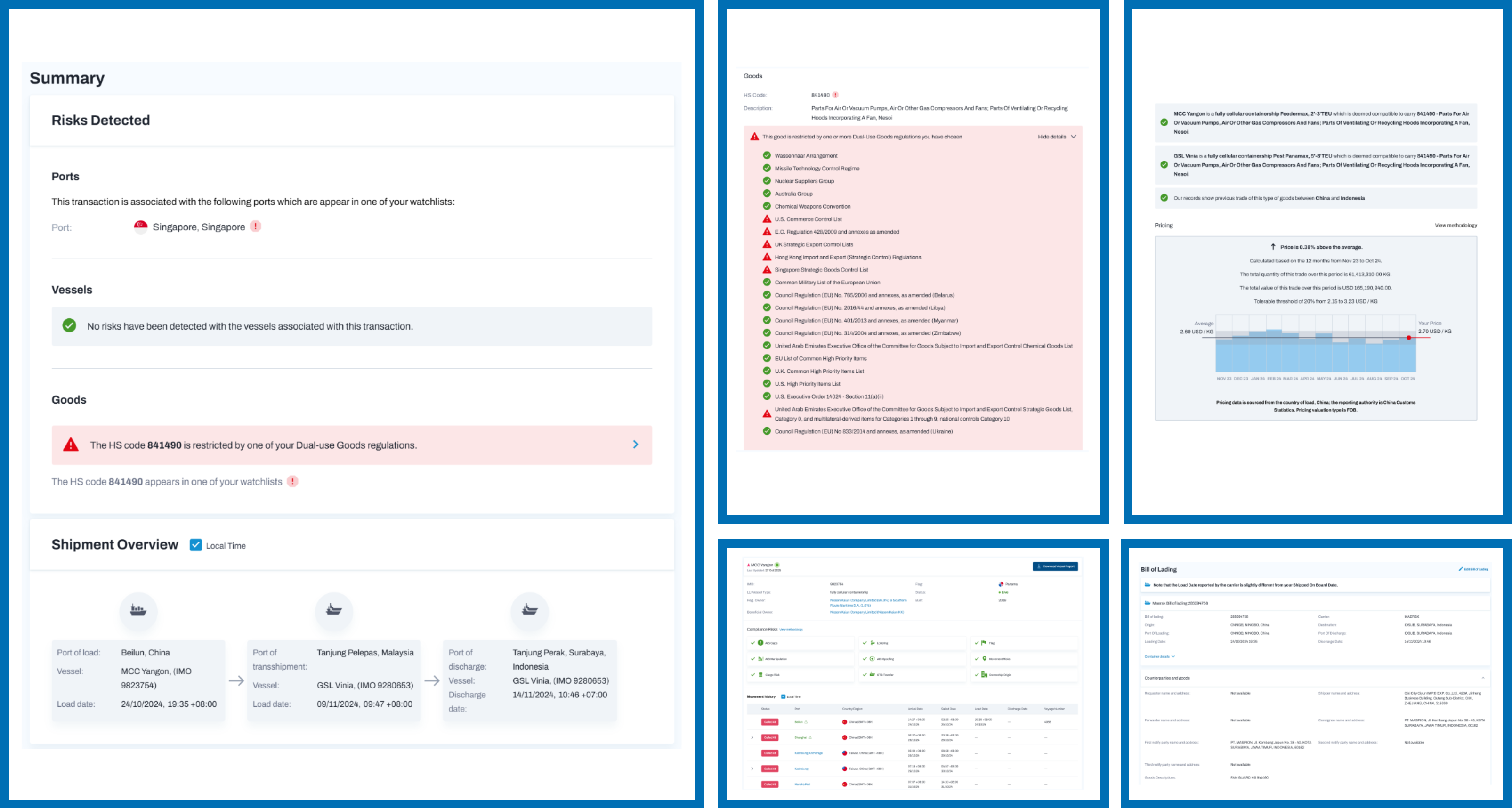

From shadow fleet activities to the growing sophistication of bad actors, sanctions circumvention and export control evasion has come to the forefront of regulatory enforcement. Organisations are facing global exposure and pressure to have effective compliance programs identifying sanctions, restricted goods, over/under invoicing and other red flags, while maintaining business continuity and an excellent customer experience. Aside from sanctions and export control enforcement, fraudulent transactions cost $5 billion annually in business disruptions.

Awarded by:

“ The tool works particularly well for commodities such as wheat and sugar, where pricing is typically based on weight (tonnes). The results aligned well with our expectations and added significant value to our process.”

Africa’s Global Bank

“SeaSearcher Trade Risk has great potential to fulfil our needs to cover all risk typologies in one solution.”

Global Financial Services

Trade compliance involves adherence to laws and regulations governing the import and export of goods across international borders. It includes customs laws, trade agreements, sanctions regulations, and export controls that businesses must follow to avoid penalties and ensure smooth operations. Effective trade compliance requires both powerful technology and expert insights to identify suspicious patterns.

While compliance departments typically oversee trade compliance processes, responsibility ultimately falls to multiple stakeholders including logistics teams, legal departments, and finance teams. Financial institutions face increasing pressure to enhance trade finance compliance while maintaining efficiency. Seasearcher Trade Risk streamlines these processes through automated verification and validation.

Common red flags include price discrepancies between invoice price and market value, circular shipping routes, transactions involving high-risk jurisdictions or goods, frequent amendments to shipping documentation, discrepancies and inconsistencies between documentation, etc.

Technology enhances trade compliance through automated screening, real-time monitoring, and data analytics that identify patterns human reviewers might miss. Seasearcher Trade Risk transforms your compliance process from reactive to proactive by instantly flagging high-risk indicators and validating shipment data against multiple sources.

Consequences can include substantial financial penalties, trade restrictions, reputational damage, and in severe cases, criminal charges against responsible individuals. Implementing robust trade compliance solutions helps organizations mitigate these risks while maintaining operational efficiency.

We have received your request and we will get back to you soon.

Lloyd’s List Intelligence has been awarded Best TBML & Trade Compliance Solution at the 8th Regulation Asia Awards for Excellence 2025, celebrated in person on 10 November 2025, for Seasearcher Trade Risk 2.0.

A closer look at the challenges of reducing TBML risk, and what compliance professionals need to do to stay ahead of the curve.