Hard to gauge true market size and share

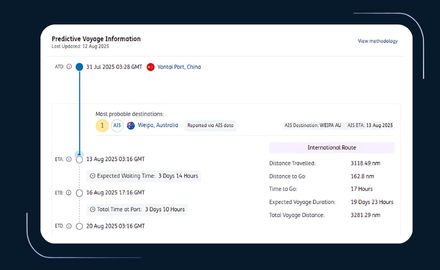

Predictive Fleet Insight

Anticipate vessel arrivals, congestion, and disruption → Improve planning and service delivery

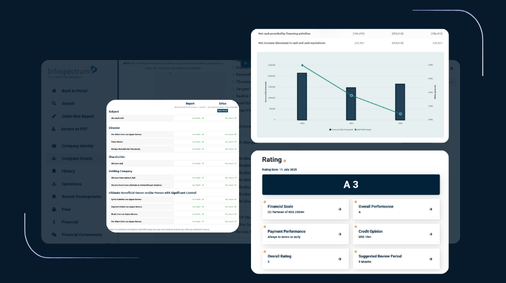

Integrated Counterparty Risk Data

Assess ownership, behaviour, sanctions exposure, and creditworthiness → Reduce risk before onboarding

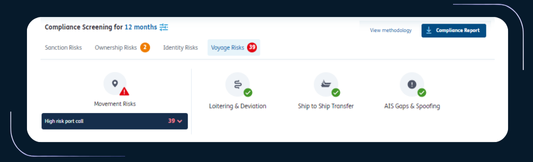

Due Diligence & Compliance Checks

Instantly screen vessels, operators, and voyages → Meet internal KYC/AML and regulatory standards

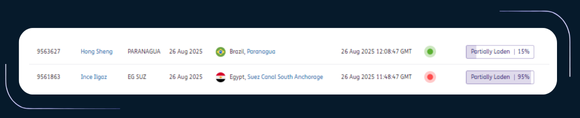

Business Development Intelligence

Identify trade flows, new operators, and market shifts → Target high-potential clients early

+

Flexible Data Delivery

Access via the Seasearcher platform or integrate via API, FTP, or

Snowflake → Seamlessly embed into your existing workflows

Ideal for:

In order to:

“Having access to the right data provides the comprehensive insight we use to make an informed decision and mitigate the risk that an entity in the fleet of an organisation we’re working with is connected to a sanction.”

— David Barker / Communications and L&D Manager at Inchcape

Yes. Maritime Commercial 360 includes credit risk indicators alongside ownership, operational history, and sanctions exposure to support comprehensive counterparty due diligence.

This is not just AIS, it’s a harmonised data environment combining live vessel movements, vessel ownership, behavioural risk, predictive analytics, market flows, and counterparty risk assessment.

You can access it through the Seasearcher Platform or feed it directly into your systems via API, Snowflake, or FTP, supporting automated risk and planning processes.

We have received your request and we will get back to you soon.