Ownership

Opportunities presented by traders call for rapid decision-making, but ensuing trades and strategy must be financially viable and compliant for any competitive advantage to be sustainable.

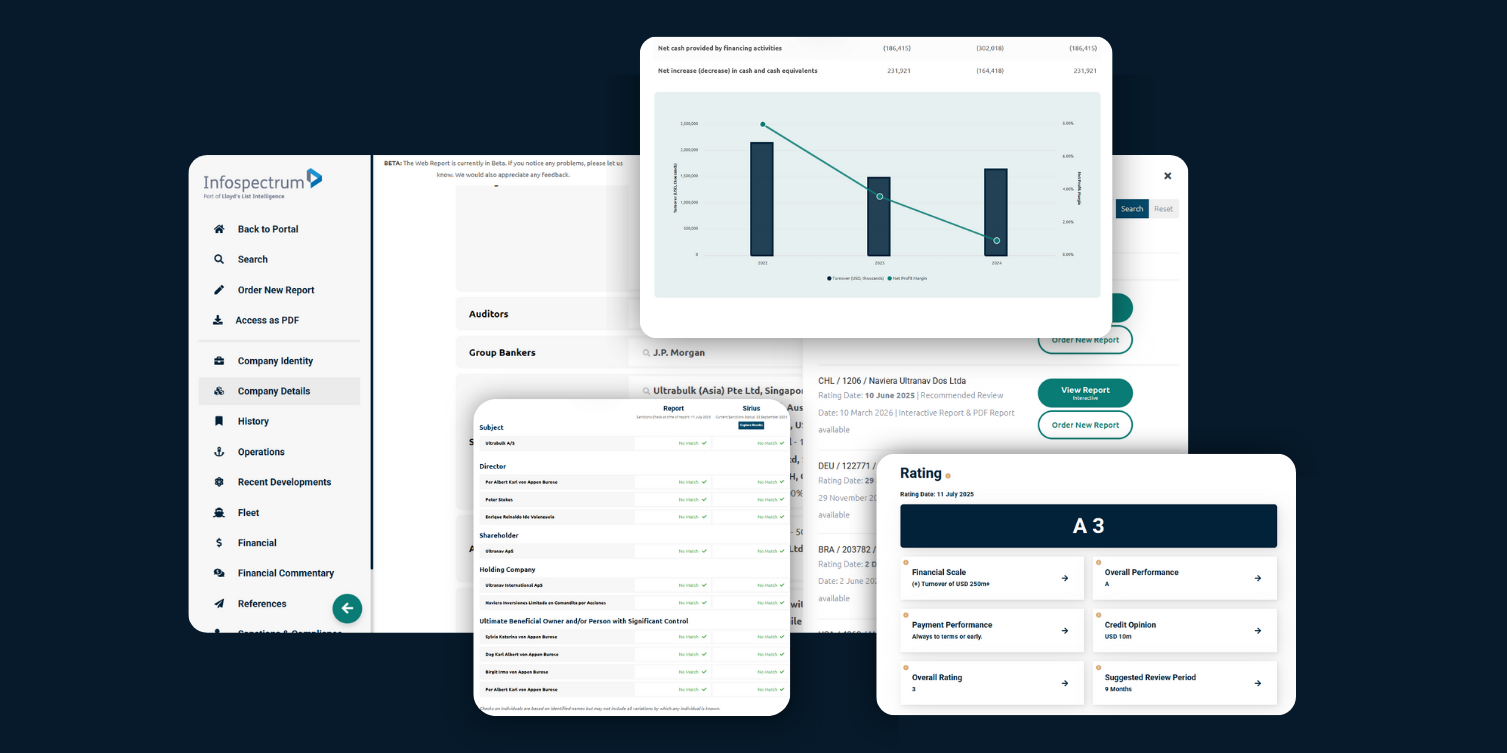

Decision-making can often be obstructed by a lack of vital intelligence on a prospect’s beneficial ownership, trading history, financial position and payment performance.

“Trusted by leaders in maritime trading sectors”

“ The reports have given us confidence that we understand the risks relative to the margins. This allows us to safely take on more business opportunities we might have otherwise missed. I can not only understand my own counterparty, but also their counterparties in turn.”

“Independent and accurate insights”

“We depend on Counterparty Risk reports to provide independent, accurate business information we can confidently rely on. We view the analysts as extensions to our own team, and continually benefit from their industry knowledge and informed judgements.”

We have received your request and we will get back to you soon.